DISCLAIMER

I am not a registered investment advisor with the SEC. Nothing in this video, should be taken as legally binding investment advice, in the same way that SEC licensed stockbrokers can advise their clients. I am not “selling” any stocks or OTC penny stocks as a broker in this video. The purpose of this video, is only to offer guidance to those who are interested in educating themselves, about self-directed investing and Biblically Responsible Investing (BRI).

Conclusion: Working two jobs from home in the country, combined with saving money through a high dividend stock, looks like a solid Puritan way to make money.

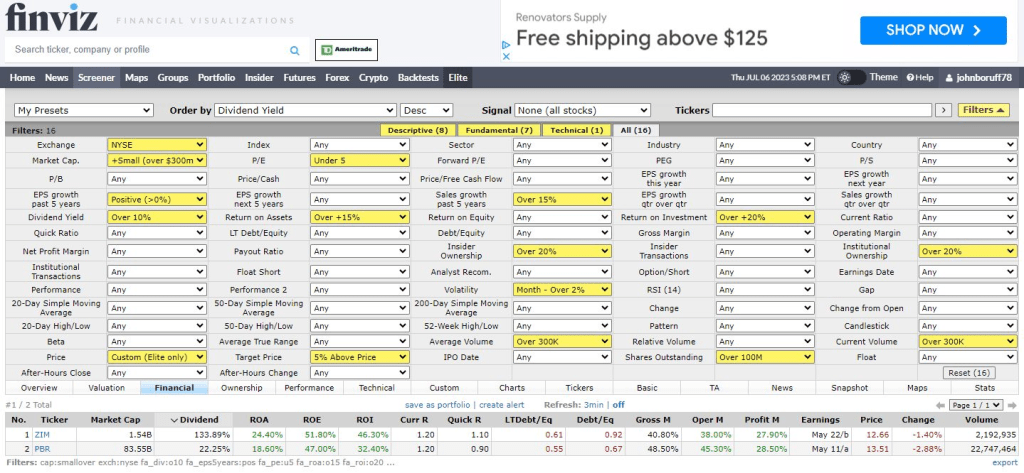

UPDATE: 7/6/23 – DAY TRADING WITH HIGH DIVIDEND STOCKS. Out of all the stocks I’ve bought and sold, during this bear market, the only stock that has started to produce a somewhat predictable profit is ZIM Integrated Shipping Services (ZIM); and I think I’ve bought and sold over a hundred different stock tickers in the past few months. The first book ever written about stocks was Thomas Mortimer’s Every Man His Own Broker in 1761, during the time of John Wesley. On pages 159 and 160, he refers to stockbrokers being given power of attorney to buy and sell stocks on behalf of their clients. He mentions the Bank of England stock, the South Sea stock, and the East India Company stock. He says that some stock rights are for “buying and selling, and receiving of dividends, which convey a most absolute and unlimited power” (p. 160). These stocks were a lot like ZIM. Although none of them produced a 100% dividend yield, they were properly dividend stocks; and could produce returns for their owners not only in the form of occasional price appreciations, or what we call price % changes or day % changes, but also in the form of monthly or quarterly dividends. Such stocks “convey a most absolute and unlimited power” of financial return for their owners. Conclusion: if you’re going to occasionally day trade, do it with a stable dividend stock: and if you want to receive big dividends, then be sure to stop day trading it before the ex-dividend date and hold it through until the pay date. This way ZIM can not only provide you with small returns by 1% and 2% day trades, but also dividends if you hold it through the right time periods. The goal should be to buy, sell, hold, and exchange hundreds if not thousands of shares of ZIM at a time. Only focus on one stock ticker. By this you are following Gerald Loeb’s philosophy, as when he said, “The greatest safety lies in putting all your eggs in one basket and watching the basket” (The Battle for Investment Survival, p. 103).