-

-

-

LATEST POSTS

RECENT VIEWS

- Review of Dr. Wayne Grudem’s “The Gift of Prophecy”

- Dr. Azzacov’s Screams of the Damned - Coast to Coast AM

- Review of Dr. Jack Deere’s “Surprised by the Voice of God”

- Leonard Ravenhill: A Man on Fire for God

- Biblical Arguments Against Eternal Security - John Wesley and Charles Finney

- Wesley Huff Says “Piece of Sh--” Four Times and Just Keeps On Talking?! - YoEz! and Michael Grant

- His Voice Was Not Heard in the Streets?

- Debunking Cessationism

- Wives Are Meant to Submit to Their Husbands

- The Coming Persecution - The Vision (1973 Prophecy) - David Wilkerson

MONTHLY ARCHIVES

- March 2026 (37)

- February 2026 (155)

- January 2026 (242)

- December 2025 (267)

- November 2025 (295)

- October 2025 (197)

- September 2025 (149)

- August 2025 (127)

- July 2025 (127)

- June 2025 (94)

- May 2025 (130)

- April 2025 (193)

- March 2025 (185)

- February 2025 (132)

- January 2025 (159)

- December 2024 (103)

- November 2024 (139)

- October 2024 (135)

- September 2024 (79)

- August 2024 (81)

- July 2024 (105)

- June 2024 (95)

- May 2024 (58)

- April 2024 (55)

- March 2024 (35)

- February 2024 (97)

- January 2024 (61)

- December 2023 (6)

- November 2023 (36)

- October 2023 (24)

- September 2023 (18)

- August 2023 (13)

- July 2023 (11)

- June 2023 (16)

- May 2023 (22)

- April 2023 (14)

- March 2023 (6)

- February 2023 (6)

- January 2023 (11)

- December 2022 (14)

- November 2022 (15)

- October 2022 (10)

- September 2022 (1)

- August 2022 (3)

- July 2022 (2)

- June 2022 (1)

- May 2022 (3)

- April 2022 (7)

- March 2022 (6)

- February 2022 (2)

- January 2022 (4)

- December 2021 (7)

- November 2021 (5)

- September 2021 (1)

- August 2021 (1)

- July 2021 (3)

- June 2021 (1)

- May 2021 (3)

- March 2021 (3)

- February 2021 (2)

- January 2021 (1)

- December 2020 (1)

- October 2020 (1)

- November 2019 (1)

- October 2019 (2)

- September 2019 (1)

- August 2019 (1)

- July 2019 (7)

- June 2019 (4)

- May 2019 (4)

- April 2019 (18)

- March 2019 (7)

- February 2019 (4)

- January 2019 (6)

- December 2018 (3)

- November 2018 (2)

- October 2018 (4)

- September 2018 (5)

- August 2018 (3)

- July 2018 (2)

- June 2018 (1)

- May 2018 (3)

- April 2018 (8)

- January 2018 (2)

- December 2017 (5)

- November 2017 (1)

- October 2017 (8)

- September 2017 (4)

- August 2017 (6)

- July 2017 (6)

- June 2017 (6)

- May 2017 (10)

- April 2017 (20)

- March 2017 (15)

- February 2017 (10)

- January 2017 (10)

- December 2016 (8)

- November 2016 (10)

- October 2016 (23)

- September 2016 (15)

- August 2016 (5)

- July 2016 (9)

- June 2016 (3)

- May 2016 (7)

- April 2016 (4)

- March 2016 (11)

- February 2016 (3)

- January 2016 (10)

- December 2015 (8)

- November 2015 (9)

- October 2015 (10)

- September 2015 (5)

- August 2015 (15)

- July 2015 (9)

- June 2015 (2)

- May 2015 (6)

- April 2015 (38)

- March 2015 (28)

- February 2015 (28)

- January 2015 (28)

- December 2014 (19)

- November 2014 (15)

- October 2014 (5)

- September 2014 (9)

- August 2014 (17)

- July 2014 (30)

- June 2014 (17)

- May 2014 (17)

- April 2014 (18)

- March 2014 (6)

- February 2014 (8)

- January 2014 (8)

- December 2013 (2)

- November 2013 (2)

- October 2013 (3)

- September 2013 (2)

- August 2013 (2)

- July 2013 (1)

- June 2013 (2)

- May 2013 (7)

- April 2013 (9)

- March 2013 (6)

- February 2013 (3)

- January 2013 (6)

- December 2012 (2)

- November 2012 (2)

- October 2012 (4)

- September 2012 (6)

- August 2012 (4)

- July 2012 (7)

- June 2012 (1)

- May 2012 (3)

- April 2012 (5)

- March 2012 (2)

- February 2012 (3)

- January 2012 (1)

- December 2011 (5)

- November 2011 (4)

- October 2011 (11)

- September 2011 (2)

- August 2011 (3)

- July 2011 (2)

- June 2011 (4)

- May 2011 (4)

- April 2011 (4)

- March 2011 (6)

- February 2011 (4)

- January 2011 (1)

- December 2010 (7)

- November 2010 (5)

- October 2010 (9)

- September 2010 (3)

-

Stop the LGBT Brainwashing of Our Students!

If anyone should cause one of these little ones to lose his faith in me, it would be better for that person to have a large millstone tied around his neck and be drowned in the deep sea.

–Matthew 18:6 (GNT)–

In the same way the men give up natural sexual relations with women and burn with passion for each other. Men do shameful things with each other, and as a result they bring upon themselves the punishment they deserve for their wrongdoing.

–Romans 1:27 (GNT)–

—

It’s Not Gay: Former Homosexuals Tell a Story Few Have Heard (AFA, 2000).

Dr. Hugh Pyle, The Truth About the Homosexuals (Sword of the Lord, 1978), pp. 8-13.

Dr. John R. Rice, Adultery and Sex Perversion (Sword of the Lord, 1978), p. 21.

American Cancer Society, “Cancer Facts for Gay and Bisexual Men.”

Posted in Uncategorized

Leave a comment

Same-Sex Attraction, the Bible, and Mortification

25 They exchanged the truth about God for a lie, and worshiped and served created things rather than the Creator—who is forever praised. Amen. 26 Because of this, God gave them over to SHAMEFUL LUSTS. Even their women exchanged natural sexual relations for UNNATURAL ones. 27 In the same way the men also abandoned natural relations with women and were inflamed with lust for one another. Men committed shameful acts with other men, and received in themselves the due penalty for their error. 28 Furthermore, just as they did not think it worthwhile to retain the knowledge of God, so God gave them over to a DEPRAVED MIND, so that they do what ought not to be done.

–Romans 1:25-28 (NIV)–

—

This bibliography has been arranged in descending order according to the level of graphic warnings about the wrath and judgment of God, the gross out factor of sodomy, and the level of urgent calls to repentance from same-sex obsession and repentance from the homosexual lifestyle. –J.B.

Samuel Danforth, The Cry of Sodom Enquired Into (Cambridge, 1674).

Satan’s Harvest Home (London, 1749), pp. 45-59.

Maze Jackson, “Will the Homosexuals Destroy Us All?”

Dr. Carl McIntire, “The Homosexuals: God’s Judgment Against Them.”

Dr. John R. Rice, Adultery and Sex Perversion (Sword of the Lord, 1978).

Dr. Hugh Pyle, The Truth About the Homosexuals (Sword of the Lord, 1978).

ACT, The Gay Plague: Homosexuality and Disease (Alert Citizens of Texas, 1983).

Dr. Paul Cameron, etc. “Effect of Homosexuality Upon Public Health and Social Order.” Psychological Reports 64, no. 3 (1989): 1167-1179.

Tim LaHaye, The Unhappy Gays (Tyndale House, 1978).

David Wilkerson, Hope for Homosexuals (Teen Challenge, 1964).

Leonard Ravenhill, Be Ye Angry And Sin Not (Last Days Ministries, 1982).

It’s Not Gay: Former Homosexuals Tell a Story Few Have Heard (AFA, 2000).

Martin Bennett, I’m Gay…O.K.? (Last Days Ministries, 1984).

Sy Rogers, The Man In the Mirror (Last Days Ministries, 1984).

American Cancer Society, “Cancer Facts for Gay and Bisexual Men.”

Posted in Uncategorized

Leave a comment

Wives Are Meant to Submit to Their Husbands

Wives, submit to your own husbands, as to the Lord. For the husband is the head of the wife even as Christ is the head of the church, his body, and is himself its Savior. Now as the church submits to Christ, so also wives should submit in everything to their husbands.

–Ephesians 5:22-24 (ESV)–

Husbands, live with your wives in an understanding way, showing honor to the woman as the weaker vessel, since they are heirs with you of the grace of life, so that your prayers may not be hindered.

–1 Peter 3:7 (ESV)–

Woe to the wicked! It shall be ill with him, for what his hands have dealt out shall be done to him. My people—infants are their oppressors, and women rule over them. O my people, your guides mislead you and they have swallowed up the course of your paths.

–Isaiah 3:11-12 (ESV)–

—

Dr. John R. Rice, The Home: Courtship, Marriage, and Children (SLP, 1946).

Dr. John Piper, ed. Recovering Biblical Manhood and Womanhood (Crossway, 2012).

William Gouge, Building a Godly Home, vol. 1 (RHB, 2013), ch. 2.

Posted in Uncategorized

Leave a comment

The True Gospel Delivers from Vice, Depravity, and Despair – David Wilkerson

The grace of God that bringeth salvation hath appeared to all men, teaching us that, denying ungodliness and worldly lusts, we should live soberly, righteously, and godly, in this present world.

–Titus 2:11-12 (KJV)–

Posted in Uncategorized

Leave a comment

LGBT Agenda, Anti-White Rhetoric, Anti-Semitism, and Muslim Invasion–Its All Linked – Joshua Simone

Posted in Uncategorized

Leave a comment

How to Recognize a False Teacher

Screaming

For more justice

Amazonia burns

Can you hear them?

I’ll fight

To save another day

So join us

And we’ll make them leave this land

Threatening

To kill how we feel

We’ll stop them

It’ll be worth dyin’ for

When you go down

When you go down

When you go down

You go down fighting

Why? Why?

–Sepultura, “Ambush”–

—

Such men are false apostles, deceitful workmen, disguising themselves as apostles of Christ. And no wonder, for even Satan disguises himself as an angel of light. So it is no surprise if his servants, also, disguise themselves as servants of righteousness.

–2 Corinthians 11:13-15 (ESV)–

—

Walter Martin, Kingdom of the Cults (Bethany House Publishers, 1965).

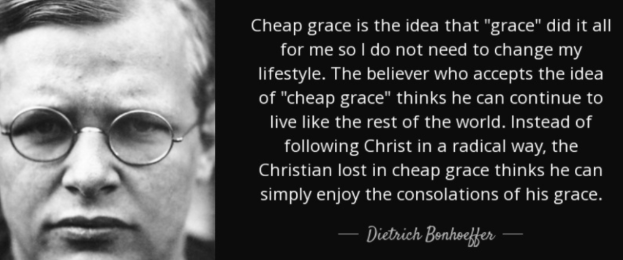

Mark Jones, Antinomianism (P&R Publishing, 2013).

Thomas C. Oden, John Wesley’s Scriptural Christianity (Zondervan, 1994).

Richard Belcher, A Layman’s Guide to the Lordship Controversy (Crowne, 1990).

Posted in Uncategorized

Leave a comment