DISCLAIMER

I am not a registered investment advisor with the SEC. Nothing in this video, should be taken as legally binding investment advice, in the same way that SEC licensed stockbrokers can advise their clients. I am not “selling” any stocks or OTC penny stocks as a broker in this video. The purpose of this video, is only to offer guidance to those who are interested in educating themselves, about self-directed investing and Biblically Responsible Investing (BRI).

—

High-Priced NYSE Stocks vs. Penny Stocks

The trade-off between investing in New York Stock Exchange stocks and venture stocks is between risk and potential reward…It’s a pretty safe bet that…you will eventually make a little money…New York Stock Exchange stocks trudge along a rather predictable course. Venture stocks pinball around with incredible velocity. –Bruce McWilliams, Penny Stocks, p. 4

—

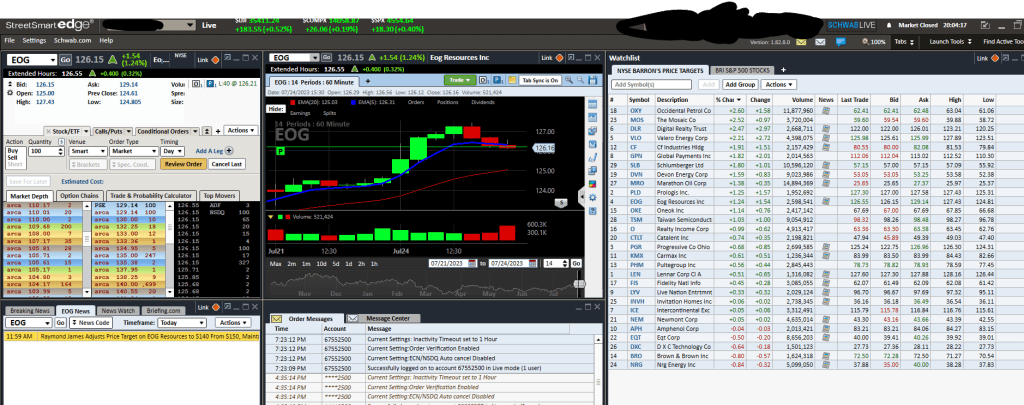

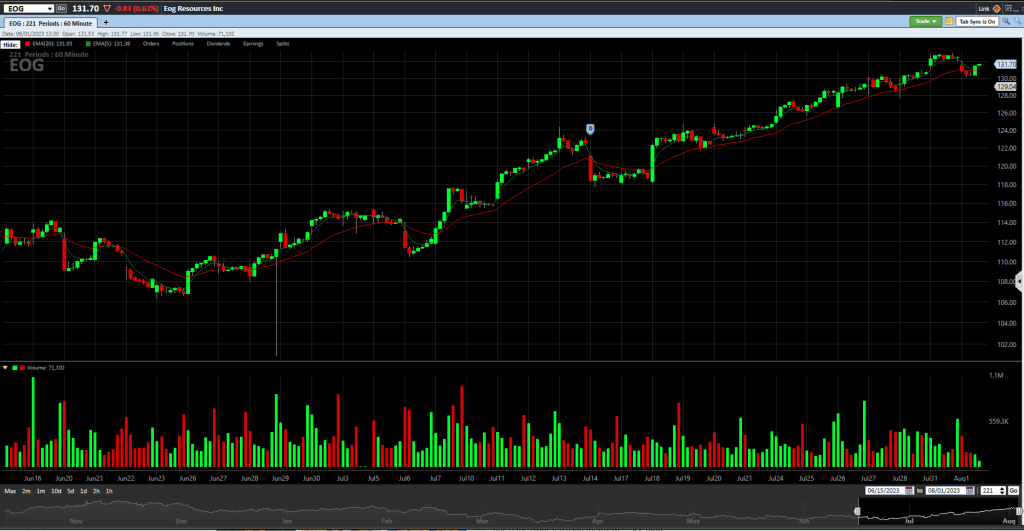

I’m definitely a Loebian investor at this point. Gerald Loeb’s Battle for Investment Survival truly makes the most sense to me: out of the 25 something books on stocks I’ve read so far. This EOG stock has been growing in price at the rate of 12.5% a month. The Barron’s price target expects it will increase a good amount. If all goes according to plan, I’ll just keep raising the stop a little bit every day to protect any new profits, that have risen above the support zone on the stock chart, which is usually traced out by the EMA 20 line on the candlestick chart. I like to keep my stop at $2 below the current support line. I like how this EOG stock is a predictable slow mover. Its price is not growing too fast like a penny stock, or making extreme drops into the red like -50% or anything, so it enables be to analyze it and control it better. As they say, “Slow and steady wins the race.” Its not an out of control stock. It feels like the stock’s direction is under control. I really like that. It gives me a relatively peaceful feeling about the whole thing.

UPDATE: 8/1/23 – I made a +$170 profit on EOG after holding the stock in an uptrend for nine days. The stock market dropped today (S&P 500 and DJIA) and so did EOG because its an S&P 500 stock. After seeing my profits drop into a negative -$82 loss today, and watching it drop even below the support line: EMA(20), I felt like my tolerance level had been reached, and I decided to sell my EOG shares. This is the 3rd most profitable trade that I’ve made; and I think the first one that was bought with a deliberate plan and not by accident. Loeb has shown me what I believe is a solid method for buying and selling a single stock:

1. NYSE / S&P 500 Stock Only.

2. High Priced. $25 to $125 a share.

3. Fundamentally Sound (F. Philip Rice). MarketWatch shows an increasing Sales/Revenue in billions of dollars on the top row of the income statement; and the Total Current Assets are at least two times the Total Current Liabilities on the balance sheet: again, in billions of dollars.

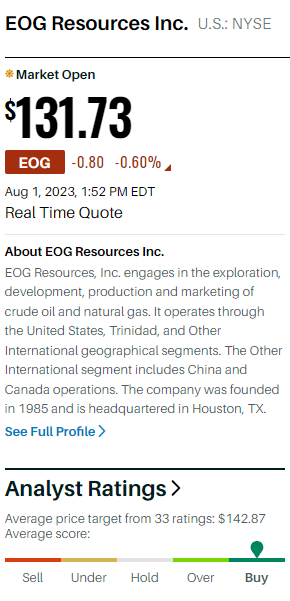

4. Barron’s Analyst Ratings: Buy. The price target was high above the current price: it was a “Buy” recommendation; and had a total of 33 ratings on the EOG stock in particular. This is a Loebian idea, but I simply decided to use Barron’s this way for guidance. I think it might be more or less reliable. The candlestick chart also showed a strong uptrend: diagonally upward to the right for five weeks.

5. Sell the Stock When You Just Can’t Take It Anymore. The good thing about EOG is that it was a slow moving stock on an uptrend, so this enabled me to analyze and control it easier. Once the new month started, August 1st, for one reason or another the stock market decided to drop and EOG along with it. Thanks to EOG being a slow mover, it also dropped at a slow speed; so it gave me plenty of hours to make a rational, if not rationally guided emotional decision to sell. My gut was telling me to sell, but because I had enough time to deliberate, my intellect finally agreed with my gut, and so I made the logical decision to sell. Out I came with a $170 profit in 9 days of holding. Not too bad considering the circumstances.